how to become a tax accountant uk

If you want to register for Gambling Tax you do not need an agent code or. People that have earned their Bachelors Degree typically make 92377 compared to 45447 for those without that.

How To Become A Tax Preparer Your Complete Guide

A tax accountant helps individuals and businesses prepare and file tax returns.

. O Relevant Fact 2. As a tax professional your regular tasks and responsibilities might include. Offering tax planning advice.

Tax accountant jobs tend to involve regular hours except towards the end of the tax year when. The good news is that to gain access to a career in accounting you dont need A levels or a degree. Here are the steps to follow for how to become a tax accountant.

How to become an accountant in the UK. The responsibilities of a tax accountant include. Tax Accountant Tips.

Tax accountants work with clients on their financial and income tax statements. They work to help clients increase their tax savings. Working towards this role.

O Relevant Fact 1. How to become an accountant in the UK. Or scroll through the whole article for a step-by-step guide to becoming a self-employed accountant.

ICAEW Associate Chartered Accountant. Study the right accounting qualifications. For trainee positions apprenticeship programmes.

Alternatively if youre looking to become an accountant and need to. Do your own taxes starting with the first year you earn income to help learn the process from the ground up. Filing tax documents on a clients behalf.

This degree is particularly premium because it is completed as part of an apprenticeship contract that includes around 3 5 years. They also ensure tax filings are accurate. The AAT qualification is typically the minimum level expected of an accountant but to ultimately become a chartered accountant youll need to.

How to become an accountant. The deadline for completing all 3 online tests was 1130am on 23. Most tax accountants hold at least a bachelors degree in accounting or a related discipline.

Tax Tax accountants help individuals and companies with all kinds of tax matters. Begin the process of becoming a tax accountant by pursuing a bachelors degree. Use your agent code or reference number to enrol the tax service you want to use onto your account.

You can become a chartered accountant by taking a degree followed by professional qualifications. Preparing federal and state tax returns. Here are the steps youll need to take if you plan to become an accountant in the UK.

Earning a Bachelors Degree in Accounting can take 4 years to complete. However if you do have a degree you can fast-track your accounting. Applications for the programme closed on 19 November 2021.

A guide to the routes to becoming an accountant and the qualifications you may need. Consulting with clients to help them prepare for tax season over the year. Gain relevant GCSEs and A levels.

If you already have a HMRC online services account and have at least one authorised. Study accounting at the undergraduate level. Application and on-line tests.

To create an agent services account you must first register with HMRC as a tax agent. Or you can work towards a degree apprenticeship as. Completing GCSE and A level qualifications is the first step in becoming a tax accountant.

Celebrating World Book Day How A Tax Accountant And Mother Of Two Followed Her Passion To Become A Published Children S Author The Dawoodi Bohras Uk

6 Things To Bring Your Accountant To Prepare Your Tax Return

How To Become A Tax Advisor Accounting Com

Questions To Ask An Account 12 Basic Questions To Get Started

Is A Cpa The Same As An Accountant There Is A Difference

What Is A Tax Advisor Skills Qualifications And Getting Started Coursera

Top 10 Accounting Skills You Need Bright Network

Senior Tax Accountant Job Description Sample Template

The Property Tax Handbook For Brrr Btl Investors By Joshua Tharby The Ultimate Tax And Accounting Resources For Investors At All Stages Of Their Property Journey Tharby Mr Joshua Sm 9798726987392

What Is A Tax Accountant Top Accounting Degrees

How To Become A Tax Preparer In 4 Steps Plus Faqs Indeed Com

6 Crypto Questions To Ask Your Tax Accountant Nextadvisor With Time

22 Best Gifts For Accountants In 2022 Accountant Gift Ideas

Self Employed Accounting Tax Software Quickbooks Uk

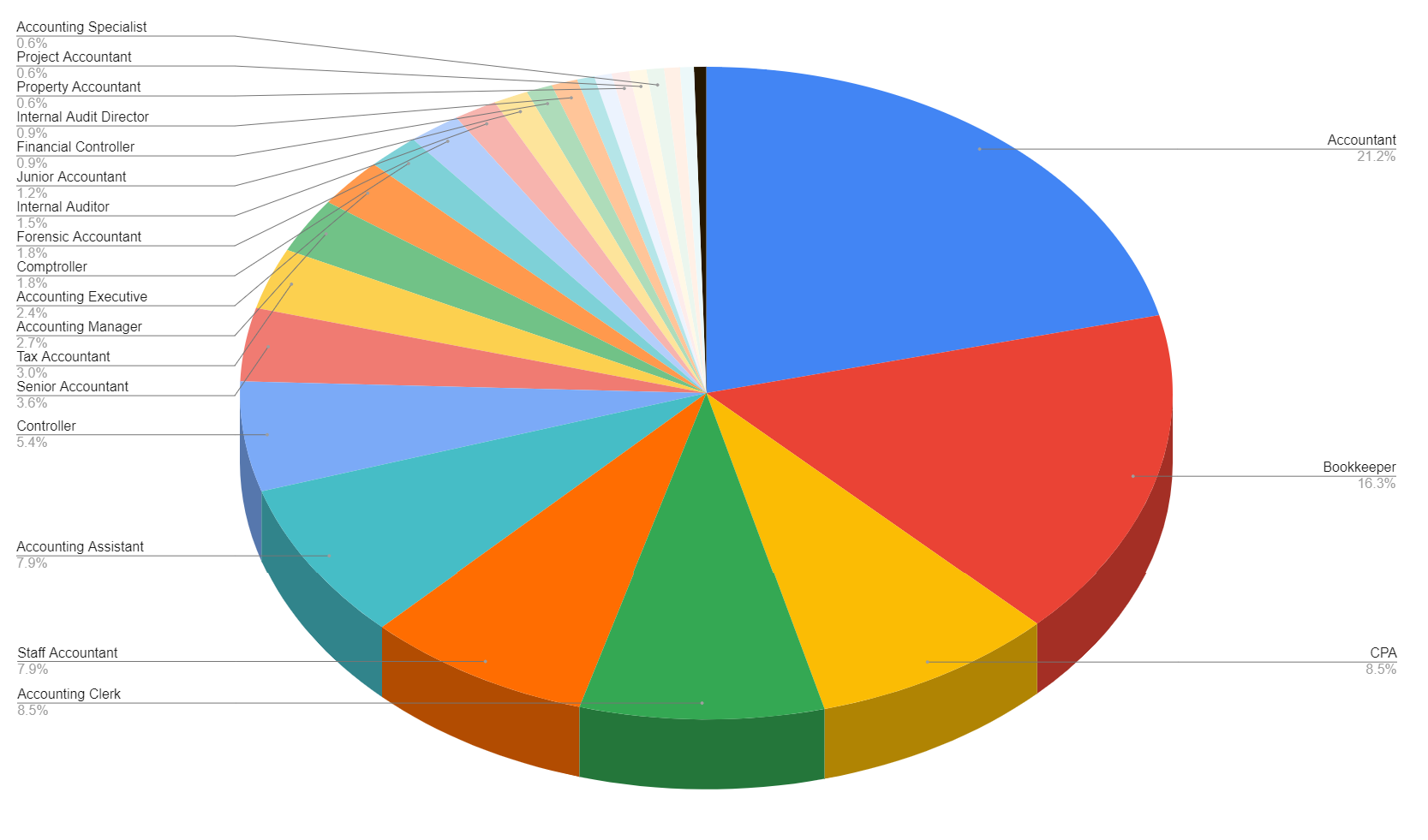

The Top 20 Accounting Job Titles Ongig Blog

Tips For Hiring A Tax Accountant North East Connected

Ultimate Accounting Tax Solutions On Twitter The Ideal Candidate For This Position Is A Qualified Chartered Accountant Who Is Interested In Providing Inquiry And Information To Our Members On Important Regulatory

What S The Difference Between A Technical Accountant And A Ca Credo Business College